Interview with Tater Tot Designs (IoT Design Company)

Tater Tot Designs is a creative design and engineering firm based in Portland that’s betting big on the Internet of Things revolution, and has built a team of EE, mechanical and software engineers, UI and UX designers to create a line of…

Here are the under-hyped areas of IoT (based on hundreds of hours of hacking)

Over the last couple of years I’ve done a ton of home automation hacking, as well as a lot of reading and tracking of emerging products in the IoT and home automation space. In the process, I’ve been able to identify some…

I took my dad to the 3D printer expo and here’s what we saw

On the weekend of 8/23, I took my dad to the 3D Printer World Expo. I should explain: My name is Ari Porad, I am 12 years old and I live in Seattle. I am also very into 3D printing, so I…

React Sidekick is hardware designed to differentiate software

The React Sidekick is a sort of portable panic button, currently available for pre-order on Kickstarter. It’s a simple concept — tap the nondescript, coin-sized button and it activates your smartphone and calls out for help. The device uses a Bluetooth LE…

Smart Home Intercom Startup Launched by Harvard Law Grad

The following is a guest post by Jonathan Frankel of Nucleus. Nucleus is a wireless, Internet-connected intercom that lets you audio- or video- chat with any other Nucleus in the world – whether it’s in the next room or next country.

I…

The Little Swarmbuddies That Could: Robotics Course Emphasizes Creativity in Engineering

Last year we covered a drawing robot arm by NarwhalEdu, and they’re back with a new robot that dances to music.

Today, NarwhalEdu is launching a second class that uses a Khan-Academy-meets-robots approach to teaching engineering at the high school level and…

Spor: Changing how we power devices

David Hunt and his co-founders at Spor are pursuing a big vision. They’re changing how devices are powered.

I recently had an opportunity to chat with David about the company as well as the successes and challenges they’ve met along the way.…

ANTVR – a VR Headset for Gaming

ANTVR KIT just launched on Kickstarter with a gamer-centric take on virtual reality headsets. Besides a headset with 1.3 megapixel display per eye and a 100° diagonal field of view, ANTVR creates an enhanced experience for VR gaming by including a multi-function…

LaMetric story: build a “look and feel” prototype before the crowdfunding campaign

Nazar Bilous is the co-founder Smart Atoms__, hardware startup that built LaMetric, and has founded several companies before, including digital agency Lemberg Solutions, Recordense.

Hardware is hard (no pun intended), especially building and delivering exactly what you’ve promised in your crowdfunding campaign.…

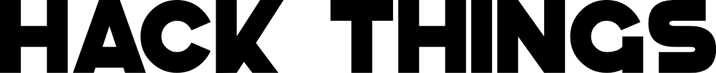

Defining Novena, our Very Own Laptop Computer

The following is a guest post by Sean “xobs” Cross, one of the two co-creators of the Novena open source laptop.

-------------------------------

Many products are hammered into existence by a cadre of project managers, focus groups and user studies. This process is…

Smartphone UI for Arduino (Annikken Andee now available on iOS)

Practically any hardware product concept these days will have a smart phone component. Not just to tap the computing power and connectivity, but because better overall user experiences can be provided.

Arduino is the rapid prototyping platform of choice for many hardware…

Piper is like dropcam but without monthly fees (review)

We just got our Piper, a home security device that combines an IP camera and various sensors into an attractive form factor and provides smartphone-based controls and an easy-to-use rules engine with push, SMS and phone call notifications. We covered Piper previously…

Marc Barros Launches Moment (interview and video)

Today, Marc Barros (who has written extensively on the topic of hardware startups) is launching Moment on Kickstarter, a high-quality lens accessory that works with most smartphones and includes an innovative adapter design that allows it to be used with or without…

Accelerators, Connected Devices, and Battery-less Devices at the Next Hack Things Meetup!

We have another fantastic lineup for the next Hack Things meetup on Monday, Dec 16, 2013. This is one to really get pumped up about.

Amulyte: First up will be Jaclyn Konzelmann, co-founder of Amulyte, which was part of YCombinator’s summer 2013…

NPS is the magic number + 4 other things I learned at Hardware Workshop

Claus Moberg is the CEO of SnowShoe and has been the driving force behind the company since its inception in 2010 as the winner of a University of Wisconsin-Madison business plan competition. Claus invented the SnowShoe Stamp to address a key bottleneck…

Hand-held Food Scanner Knows What You’re About to Eat (TellSpec)

File this under “technology you thought was science fiction”. TellSpec (4 days left on IndieGogo) is a pocketable food spectrometer that you can aim at your food and perform on-the-spot analysis to obtain information such as whether the food you’re about to…

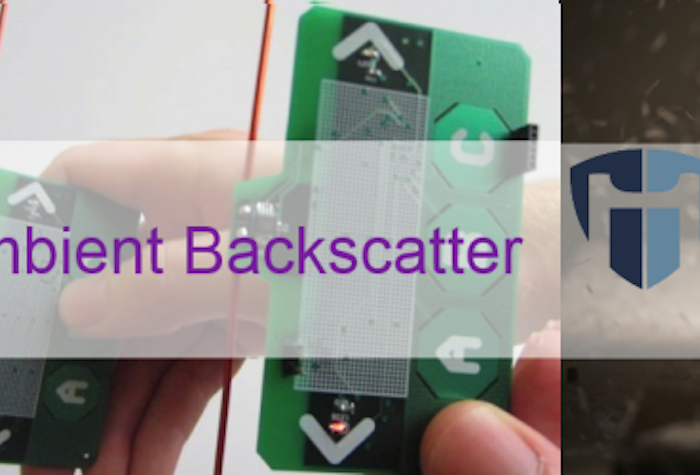

Back Cortado (Wireless Arduino Dev Board) and Get Notified When it Arrives in Your Mailbox

Cortado just launched — it’s a nicely-designed, very small-footprint arduino board (an inch and a half or so in length) designed for wireless applications. The whole idea behind it is giving the user the ability to turn just about anything into a…

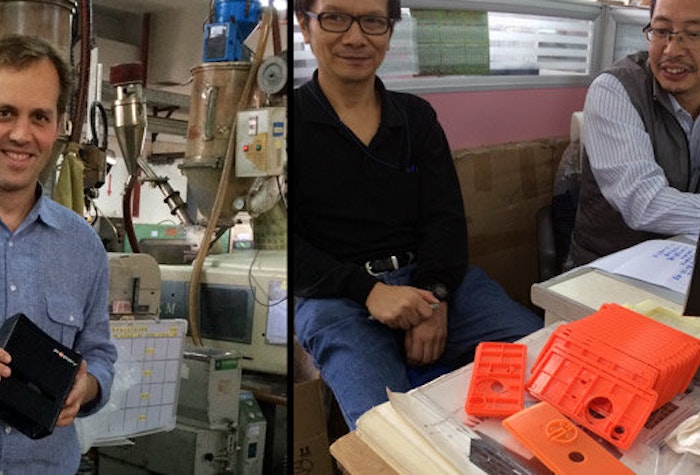

The innovation advantage of being in China

In software the key to innovation is rapid iteration. That’s much more challenging with hardware, and working remotely with a Chinese manufacturer has been excruciating at times. You discuss a change, then wait days or weeks to see the results. Skype and…

Check out HAXLR8R’s Latest Batch of Hardware Startups

Here’s a run-down of the latest batch of HAXLR8R companies that made their debut last week. We’ve already written about Roadie Tuner, currently live on Kickstarter, but there are a ton of other great companies spanning wearables, gaming, entertainment and medical devices.…

Poppy in production

I’m in China visiting our factory as we begin production of Poppy, our inexpensive and battery-free gadget that turns your iPhone into a 3D video recording and playback device. We have been working on this for almost a year now, and raised…